For independent e-commerce sites, payment methods directly impact costs, fund arrival speed, and compliance risks. Wise (formerly TransferWise) is renowned for its multi-currency accounts, real exchange rates, and transparent low fees, making it a suitable payment tool for independent e-commerce sites. However, it is not a one-stop solution—you need to pair it with card payment gateways, invoicing, and risk control strategies to ensure stable operations.

Below is a detailed breakdown of Wise’s advantages, applicable scenarios, and the full process from account opening to launching payment collection.

I. What Are the Benefits of Using WISE for Independent E-commerce Site Payments?

1. Multi-Currency Local Receiving Accounts

You can obtain account details similar to local bank accounts, allowing overseas customers/channels to pay via local transfers (e.g., ACH, SEPA, or GBP transfers). This reduces the payee’s fees and improves their fund arrival experience.

2. Transparent, Mid-Market Exchange Rates & Low Fees

Wise uses the mid-market rate, and its service fees are typically much lower than those of PayPal or traditional banks—this is especially cost-effective for large amounts or frequent transactions.

3. Convenient Account Management & Currency Exchange

Hold over 40 currencies in a single account and exchange currencies on demand at any time. It supports bulk payments (via bulk upload), which simplifies reconciliation and supplier payments.

4. API & Automation Capabilities

Wise offers an open API that can be integrated with your independent site’s backend, ERP, or accounting system. This enables automatic reconciliation, automatic fund transfers, and bulk payments—ideal for large-scale operations.

5. Compliance & Credibility

As a regulated financial institution, Wise has mature fund custody and compliance procedures, reducing the compliance risks associated with using personal or small business bank cards for custody.

Note: If your site primarily relies on consumer card/Instant payments (e.g., credit cards, Apple Pay), Wise itself is not a card payment gateway or custodial payment processor. It excels at bank transfers and account transactions, so it usually needs to be used in conjunction with payment gateways like Stripe, PayPal, or Adyen.

II. Complete Guide to Receiving Payments with WISE for Independent E-commerce Sellers

1. Preparation

- Confirm your target customer base and commonly used currencies: If your main customers are in Europe and North America, prioritize opening local receiving accounts for GBP, EUR, or USD.

- Evaluate your payment types: Determine if you operate in B2B (commonly using bank transfers/wire transfers) or B2C (primarily using card payments). For B2B, you can have customers transfer funds directly to your Wise local account; for B2C, use a combined solution of Wise + card payment gateways.

- Prepare company documents for KYC: Gather business licenses, registered addresses, identification documents of the person in charge, and VAT/tax identification numbers (if applicable). Preparing these in advance speeds up the verification process.

2. Account Opening & Setup

- Register for a Wise Business account: Select the “Business” account type, fill in your company information, and submit KYC documents. Once approved, your corporate multi-currency account will be activated.

- Obtain local receiving account details: Add the required currencies in the Wise dashboard to get the corresponding local account information. Display these receiving account details in your independent site’s backend or on invoices.

- Set default settlement and automatic currency exchange rules: You can choose to keep funds in the original currency or automatically exchange them into your operating currency. Be aware of Wise’s currency exchange fees and fluctuations—if necessary, set up manual currency exchange to take advantage of better rates.

- Enable bank transfer/invoice payment collection: Use your Wise account to receive bank transfers from customers, or include your local account information on invoices (suitable for B2B customers).

- Apply for a Wise Card: For certain business needs, apply for a business debit card to cover daily expenses and reduce withdrawal operations.

3. Integration with Independent E-commerce Sites

(1) Bank Transfer/B2B Payment Collection from Customers

- Clearly state the Wise local account information and order number/reference code on the checkout page or invoice.

- After confirming fund arrival, manually or automatically issue shipping instructions. This method is suitable for large-value orders or wholesale transactions.

(2) Card Payments as the Main Method (B2C)

- Use Stripe, Adyen, or PayPal for front-end card payment processing (supports card numbers and convenient payment methods like Apple Pay).

- Set the settlement and receiving address of these gateways to a bank account you can access—you can choose Wise’s local USD, EUR, or GBP account as the receiving/settlement account (confirm that the gateway supports settling funds to external bank accounts first).

Important Notes:

- Not all gateways support direct settlement to Wise.

- Some gateways require funds to first go to their designated settlement bank before being transferred out. It is recommended to confirm the settlement path and fees with the gateway’s customer service.

4. Compliance & Account Security

- Ensure KYC/business descriptions are truthful and detailed: Information such as business type, product categories, main markets, and expected transaction volume must match reality to avoid triggering restrictions due to inconsistent information.

- Keep complete invoices, contracts, and shipping documents: Prepare verifiable documents for platforms/banks, so you can respond quickly to review requests.

- Maintain a stable login environment and IP management:

If you operate multiple platforms/multiple accounts or frequently log in to Wise from different countries, the platform’s risk control system may regard frequently switched IPs/regions as risky behavior, leading to additional reviews or limits.

To reduce the risk of false triggers, use stable, quality-controlled proxies or enterprise-level static IPs for fixed office/environment logins and automated integrations.

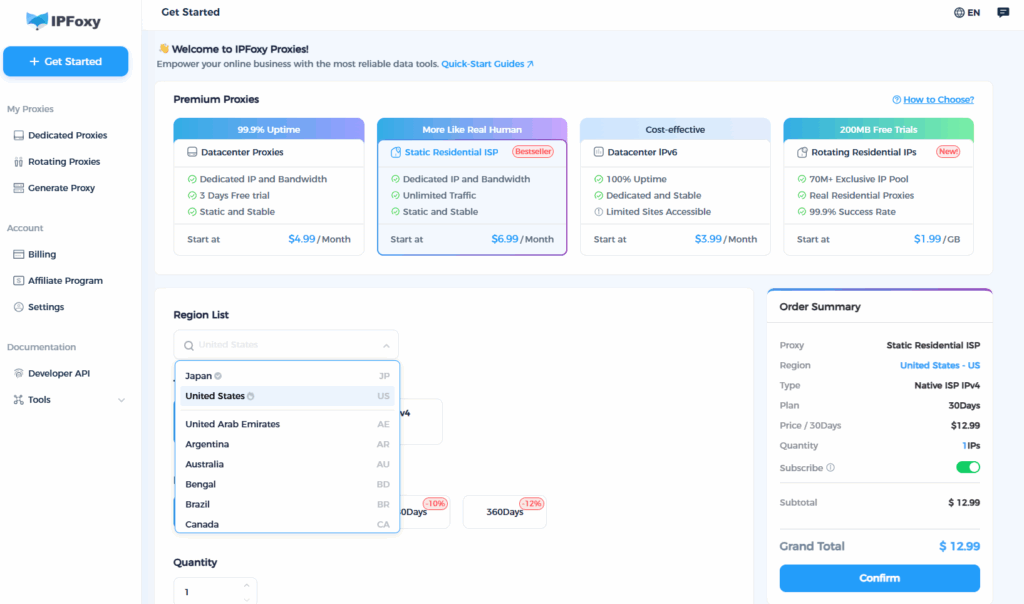

If you need enterprise-level, stable proxies to support cross-border payment operations, account management, and testing, IPFoxy provides static/dedicated proxies with broad geographic coverage to address these needs. When using proxies, it is recommended to choose static clean IPs, configure regions based on business scenarios, and ensure the proxies come from legal and compliant sources.

Conclusion

For independent e-commerce sellers, Wise is a powerful tool for “low-fee, multi-currency local payment collection + automation capabilities.” It is particularly suitable for businesses that rely on bank transfers/B2B transactions or need low-cost cross-border settlements—helping you reduce costs, streamline transaction flows, and minimize compliance risks.