For many independent website (DTC) sellers, especially beginners, PayPal is undoubtedly the most common payment method. It’s easy to use, globally accepted, and trusted by consumers worldwide. However, many sellers face a frustrating problem: even before their site gets its first order, or right after linking a PayPal account, the account suddenly gets frozen.

So what’s really going on? Is PayPal particularly unfriendly to new sellers? Don’t worry—this survival guide will uncover the logic behind PayPal’s risk control and provide you with a set of proven strategies to keep your account safe, ensuring smooth payment collection for your store.

I. Why PayPal Freezes Accounts: Full Breakdown

You might think: “My account hasn’t had any transactions, so how could it trigger risk control?” In reality, PayPal’s review system is much stricter than you imagine. Here are the most common reasons why your account may be frozen:

1、Mismatched Account Information

This is the most basic but often overlooked issue. The name, address, phone number, and other details you enter when registering must exactly match your bank card and ID documents. If there are any discrepancies, PayPal will doubt the authenticity of your identity and flag the account.

2、New Account, Old IP

If you register a new PayPal account using an IP address that was previously used for PayPal or other e-commerce platforms, PayPal’s system will immediately get suspicious. It will link your new account with the old IP history, and if that IP had a bad record, your new account faces a much higher risk of being frozen.

3、Suspicious IP or Login Locations

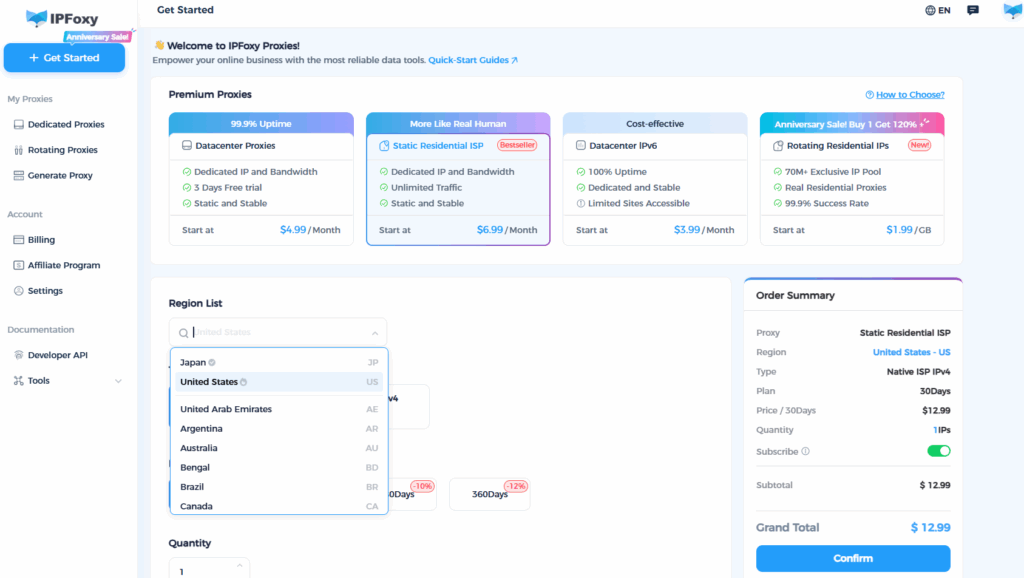

One of the top triggers for PayPal’s risk system is abnormal IP usage. For example, if you register a PayPal account in one country but frequently log in from the U.S. or Europe, PayPal may assume the account has been compromised or is engaged in fraud, leading to suspension. That’s why having a stable, localized IP is absolutely essential.

4、Sensitive Products or Keywords

Even if your store hasn’t generated orders yet, PayPal will scan your website content. If your products involve counterfeits, infringements, adult items, pharmaceuticals, e-cigarettes, or your site contains keywords like “replica” or “high copy,” your PayPal account may be directly banned—even without transactions.

5、Mismatch Between Account Type and Website

PayPal also fetches your site information via API. If you’re using a personal account but your website clearly shows business activity (e.g., selling a wide range of products, displaying a company profile), PayPal will request that you upgrade to a business account. Failure to do so may lead to restrictions.

II. PayPal Survival Guide for Payment Accounts

1、Ensure Account Authenticity

- Use real identity information: Make sure your registration details fully match your ID and bank card information.

- IP setup matters: PayPal’s compliance checks are strict, and even small environmental anomalies can trigger freezes. Registering and using PayPal requires a local IP and a stable account environment.

2、Maintain Healthy Account Behavior

Bind your website and show products: Link your PayPal to your independent store early. Make sure your site clearly displays product info, contact details, and return/refund policies.

Avoid large transactions at the start: Don’t process big payments right away. Start with smaller amounts, gradually scaling up to build account trust.

Ship promptly and upload tracking: For every transaction, ship quickly and provide valid tracking numbers. This reduces complaints/refunds and improves your account standing.

Handle disputes and refunds properly: Communicate with buyers quickly if disputes arise, and provide solid evidence. A positive dispute-handling record makes PayPal more confident in your account.

Conclusion

For new independent sellers, PayPal freezes can be a huge headache. But once you understand the logic behind its risk controls and take the right precautions, you can effectively avoid problems.

The three golden rules are: keep account info consistent and authentic, use clean and independent IP addresses, and avoid sensitive products. Follow these, and your PayPal payment account will stay safe. Hopefully, this survival guide helps you build a smoother and more reliable payment journey for your independent store.